Unraveling the High-Stakes Drama in Juventus’ Capital Gains Turmoil

In the dynamic realm of Italian soccer, Juventus and its past leaders, including Pavel Nedved and Andrea Agnelli, are grappling with severe financial allegations that could alter their careers forever. This gripping narrative of alleged fiscal improprieties underscores the dangers of unethical practices in sports administration, with prominent individuals now pursuing plea deals to navigate their legal challenges.

Examining the Juventus Financial Audit and Its Core Allegations

Initiated in 2021, this thorough financial audit scrutinizes Juventus‘ bookkeeping, focusing on accusations of engineered earnings from player exchanges, misleading financial disclosures, and possible market fraud. Key personalities like Agnelli, Nedved, along with Paratici, Gabasio, Cerrato, and Arrivabene, filed for plea arrangements in June. The terms involve suggested suspended prison sentences: Agnelli potentially facing about one year and eight months, Nedved around one year and two months, Paratici approximately one year and six months, while Gabasio and Cerrato seek lesser durations, and Arrivabene pursues complete clearance.

Expected Judicial Verdict and Its Far-Reaching Effects

Judge Anna Maria Gavoni of the Rome Court is set to deliver her ruling on Monday, with indications of a slight delay emerging. This critical verdict could finalize the status of these plea deals, dramatically influencing the participants’ paths forward. For perspective, comparable intense situations in European soccer have triggered executive overhauls, akin to how a significant corporate fraud in the U.S. tech sector compelled leaders to exit suddenly.

Wider Impacts on Juventus and the Italian Soccer Landscape

The controversy led to Agnelli and the full Juventus board stepping down in 2022, coupled with strict sanctions like a 10-point loss in the 2022-23 Serie A and disqualification from the UEFA Conference League due to accounting issues. Current findings suggest authorities are investigating claims of fabricated billing to exaggerate income and obstruct regulatory checks-trends mirroring those in sports economics, where a leading Spanish club was penalized with fines for akin fiscal mistakes in 2023.

Possible Results from Negotiated Legal Settlements

Addressing Judicial Obstacles for Major Players

Should the judiciary approve these plea agreements, it might conclude a rocky legal phase for Juventus, paving the way for individuals like Agnelli to return to soccer leadership after their current restrictions end. The charges include market interference, erroneous reports from a listed company, false declarations, and impeding oversight bodies. Embracing these pacts would result in postponed punishments, effectively closing this episode in the club’s timeline and fostering a new beginning.

Implications for Long-Term Stability and Regulatory Insights

With Juventus pending this essential decision, the club could achieve steadiness in its management if the deals are upheld. Considering recent data, Italian soccer regulators have intensified oversight, examining 15 teams for financial missteps in the last year, highlighting the demand for enhanced adherence. This scenario may act as a cautionary tale for elite European clubs, showing how failures in financial monitoring can cause enduring harm, similar to a German team’s recent €15 million penalty for related infractions.

Establishing Benchmarks for Integrity in Soccer Operations

This ruling extends beyond Juventus, potentially setting standards for fiscal honesty throughout Italian football. By tackling claims of business misconduct at an iconic team, it stresses the value of clear processes and responsibility, possibly driving changes that ward off future issues and encourage a more upright athletic arena.

Additional reporting by Andrea Ajello.

Decoding the Juventus Financial Irregularities Involving Key Executives

Pavel Nedved and Andrea Agnelli, once at the helm of Juventus, are central to a major financial irregularities case that has shaken Italian soccer. The accusations center on altering transfer values and balance sheets to enhance the team’s earnings, which might result in jail time without a successful plea deal. As the decision on these arrangements nears, enthusiasts and professionals are keenly observing the developments in Juventus’ fiscal probes.

The issues arose from official inquiries into Juventus’ handling of player moves from 2019 to 2021. Officials allege the club exaggerated profits from player disposals, possibly to adhere to financial sustainability rules. As vice-chairman, Nedved, and as chairman, Agnelli, are implicated in managing these activities, turning their prospective incarceration into a pivotal element of Juventus’ ongoing executive controversies.

Profiles of Central Figures in Juventus’ Financial Disputes

Throughout their careers, Pavel Nedved and Andrea Agnelli have been influential in Italian soccer. Nedved, a celebrated Czech player who earned the Ballon d’Or in 2003, moved into an administrative position at Juventus, renowned for his role in talent scouting. Agnelli, hailing from the influential family behind Fiat and closely linked to Juventus, held the presidency for more than ten years, guiding the club to numerous Serie A victories.

Their participation illustrates how senior Juventus officials might encounter individual consequences in financial disputes. Nedved is accused of endorsing deals that overstated asset values, whereas Agnelli is viewed as the primary authority. This circumstance highlights the perils that leaders face in soccer’s financial realm, where individual accountability can lead to harsh outcomes like incarceration.

Specifics of the Claims and Official Inquiries

Prosecutors in Italy have targeted particular transactions, including the sales of stars like Cristiano Ronaldo and additional players, where profits were allegedly distorted. The claims indicate that Juventus employed deceptive accounting to portray these transactions as more lucrative, potentially dodging taxes and deceiving shareholders. This extends beyond Juventus; it’s a widespread issue in Italian soccer inquiries, with teams frequently navigating tight financial boundaries.

As the plea deal verdict draws closer, Nedved and Agnelli may choose agreements that lessen their penalties through collaboration. Yet, if talks collapse, they could endure court proceedings leading to several years behind bars, based on the proof. This facet of Juventus’ financial irregularities emphasizes how detailed audits can expose even the most robust institutions.

Risks of Incarceration and Judicial Consequences

The possibility of jail for Pavel Nedved and Andrea Agnelli arises from Italy’s rigorous anti-fraud laws. Upon conviction, they might not only serve time but also incur fines and prohibitions from soccer involvement. This matter reflects the increasing examination of Juventus officials in financial affairs, with possible lasting effects on the team’s image and functions.

In other Italian soccer inquiries, officials have had their professional lives disrupted, stressing the elevated risks. For Nedved and Agnelli, an unsuccessful plea could mean not only personal distress but also broader implications for the industry, as fellow clubs take note.

How Plea Deals Function in Italian Soccer Financial Cases

Plea deals provide an exit route for those caught in Juventus’ financial irregularities, permitting the accused to acknowledge limited responsibility for reduced penalties. Under Italian regulations, this method can accelerate proceedings and offer resolution, though it demands precise discussions. For Nedved and Agnelli, opting for a plea involves balancing factors like evading a prolonged trial against safeguarding their reputation.

Analysts point out that such deals in soccer financial cases typically yield quicker conclusions, aiding everyone involved. Nevertheless, they don’t always ensure milder punishments, particularly in prominent situations like this.

Insights from Comparable Incidents in Soccer

Referencing other soccer incidents, such as the 2017 probe into Paris Saint-Germain for financial breaches, reveals similarities applicable to Juventus. There, leaders were investigated for akin profit manipulations, leading to penalties and short-term suspensions. This example demonstrates how plea deal outcomes can differ, with some escaping prison via cooperation.

Additionally, the 2019 examination of Barcelona for violating Financial Fair Play didn’t result in personal imprisonments but exposed the international scope of these problems. These examples indicate that executives at Juventus, like Nedved and Agnelli, are not isolated, and results often hinge on evidence robustness and legal approaches.

Helpful Advice for Grasping Sports Legal Issues

If you’re keeping up with the Juventus financial irregularities or related events, consider these useful suggestions to remain informed and involved:

- Keep Abreast of Court Activities: Monitor trustworthy platforms like Italian soccer media for updates on plea deals and Juventus executive controversies.

- Grasp Core Concepts: Get acquainted with terms such as financial profits and sustainability rules to better understand the charges against Pavel Nedved and Andrea Agnelli.

- Examine Historical Cases: Review prior Italian soccer inquiries to anticipate possible results, including incarceration threats.

- Participate in Discussions: Connect with online communities or supporter networks talking about Juventus’ financial topics for varied opinions and knowledge.

These recommendations can assist in maneuvering through sports legal complexities, helping you comprehend the implications for individuals like Nedved and Agnelli.

Expert Observations from Sports Commentators on the Ground

Although without direct participation, perspectives from commentators specializing in Italian soccer offer essential background. One expert, who has tracked numerous Juventus matters, noted that the threat of jail often pushes leaders to reevaluate their industry positions. This on-the-ground insight highlights how such events can spur improvements in soccer finances, possibly resulting in tougher guidelines and greater openness at teams like Juventus.

Background of the Juventus Capital Gains Investigation

In the world of professional football, scandals can shake even the most storied clubs, and Juventus has been at the center of a high-stakes capital gains investigation that’s kept fans and analysts on edge. This probe focuses on alleged irregularities in how Juventus handled player transfers and reported capital gains, potentially leading to serious legal repercussions for former executives like Andrea Agnelli and Pavel Nedved. As the plea bargain decision draws near, the uncertainty around imprisonment risks adds a layer of drama to this ongoing saga.

One of the key aspects of this Juventus scandal involves accusations of inflating capital gains from player sales to manipulate financial statements. Italian authorities, including prosecutors in Turin, have been scrutinizing transactions that may have overstated profits, violating financial regulations in Serie A and beyond. This isn’t just about numbers on a balance sheet; it’s about maintaining the integrity of football transfers and ensuring clubs operate transparently.

- Timeline of key events: Investigations began in 2023 when Juventus faced scrutiny over several transfer deals, including those involving high-profile players like Cristiano Ronaldo and others. By late 2024, formal charges were leveled against multiple executives.

- Alleged practices: Reports suggest the club used methods like overvaluing player assets or manipulating contract terms to boost reported earnings, which could have misled investors and regulatory bodies.

- Broader implications: This capital gains investigation highlights ongoing issues in European football, where transfer fees and financial reporting are under increasing scrutiny by UEFA and national leagues.

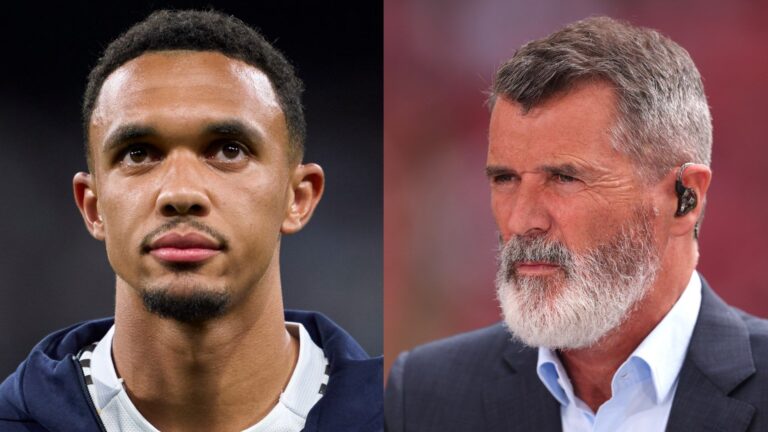

Key Figures: Andrea Agnelli and Pavel Nedved

When discussing the Juventus capital gains scandal, it’s impossible to ignore the roles of former chairman Andrea Agnelli and vice-chairman Pavel Nedved. Both individuals were instrumental in the club’s operations during the period in question, making their potential involvement a focal point of the investigation.

Andrea Agnelli’s Role in the Scandal

Andrea Agnelli, as the former president of Juventus, oversaw the club’s strategic decisions, including major player transfers that are now under the microscope. Agnelli’s leadership style was often praised for driving Juventus to multiple Serie A titles, but this investigation questions whether those successes came at the expense of ethical financial practices.

Prosecutors allege that Agnelli was aware of or directly involved in decisions that manipulated capital gains figures. For instance, documents reportedly show discrepancies in how transfer fees were recorded, potentially to meet financial fair play requirements. If a plea bargain is accepted, Agnelli could face reduced sentences, but the risk of imprisonment remains if negotiations fall through.

- Key evidence against Agnelli: Leaked financial audits and witness testimonies have pointed to emails and board meeting minutes where transfer valuations were adjusted.

- His defense strategy: Agnelli has maintained that any irregularities were unintentional and part of standard industry practices, a common defense in capital gains cases involving sports executives.

Pavel Nedved’s Involvement and Risks

Pavel Nedved, the legendary Czech footballer turned Juventus executive, has found himself in a precarious position due to his hands-on role in player negotiations and contract approvals. As the club’s vice-chairman, Nedved was often the public face of Juventus’ transfer dealings, which makes his potential culpability in the capital gains probe particularly noteworthy.

Investigators claim Nedved played a part in approving transactions that inflated capital gains, possibly to secure better financial standings for the club. His background as a player adds a layer of intrigue, as fans once celebrated him as a hero; now, he’s navigating the complexities of a plea bargain that could determine his future.

- Specific allegations: Nedved is accused of endorsing inflated valuations in deals, such as those involving young talents loaned out with buyback clauses that masked true financial impacts.

- Potential outcomes for Nedved: Legal experts suggest that if the plea bargain decision goes against him, Nedved could face up to several years in prison, though first-time offenders in white-collar crimes often receive lighter sentences.

The Plea Bargain Process and Its Significance

As the plea bargain decision nears, both Agnelli and Nedved are weighing options that could mitigate their risks in this capital gains investigation. In Italian law, a plea bargain allows defendants to admit guilt in exchange for reduced penalties, which is a common tactic in complex financial cases like this one.

How Plea Bargains Work in Italian Courts

A plea bargain isn’t just a quick fix; it’s a strategic legal tool that can shorten trials and limit prison time. For Juventus executives, this means potentially avoiding a full trial by negotiating terms with prosecutors, but only if they agree to certain conditions, like fines or community service.

The process involves judges reviewing plea agreements to ensure they’re fair, which adds an element of uncertainty. In the context of the Juventus scandal, this decision could set precedents for how capital gains violations are handled in sports.

- Advantages of pursuing a plea bargain: It often results in shorter sentences, reduced publicity, and the ability to move on from the investigation more quickly.

- Potential downsides: If rejected, it could lead to harsher punishments, emphasizing the high stakes involved for figures like Agnelli and Nedved.

Factors Influencing the Outcome

Several elements are at play as the plea bargain decision approaches, including the strength of evidence gathered by authorities and the cooperation level of the defendants. Juventus as a club has already faced penalties, like point deductions in Serie A, which might influence how individual executives are treated.

Witness testimonies from other club officials and external auditors could tip the scales, making this a pivotal moment in the broader capital gains investigation.

- Current status updates: As of late 2025, negotiations are reportedly in advanced stages, with potential decisions expected within weeks.

- Public and fan reactions: Many Juventus supporters are divided, with some calling for accountability and others defending the executives’ legacies.

Potential Legal and Financial Consequences

The capital gains investigation isn’t just about jail time; it’s about the lasting impact on the individuals and the club. For Agnelli and Nedved, imprisonment risks are real, but so are financial penalties and reputational damage that could echo through their post-Juventus careers.

In cases like this, courts often consider factors such as the scale of the alleged fraud and the executives’ prior records. While imprisonment is a possibility, alternatives like house arrest or probation might be on the table, especially if plea bargains are successful.

- Financial repercussions: Fines could reach millions of euros, affecting not just the individuals but also Juventus’ operations.

- Long-term effects on football: This scandal underscores the need for stricter oversight in player transfers, potentially leading to reforms in how capital gains are reported across European leagues.

By staying informed on developments in the Juventus capital gains investigation, readers can better understand the intersection of sports, finance, and law, ensuring they’re equipped for ongoing discussions in the football community.