Exposing the Perils of Investment Frauds Preying on Retired Football Legends

In the glamorous yet perilous realm of professional football, where celebrity and wealth frequently intersect, a worrisome pattern of financial predators has surfaced, leaving ex-players to contend with severe setbacks. This piece explores the troubling account of a well-known former Liverpool footballer and Match of the Day commentator who was ensnared in a deceptive financial plot, spotlighting the essential demand for improved defenses in the sector. Financial scams targeting retired athletes have gained heightened examination, impacting not only personal finances but also the wider sports landscape.

- A once-celebrated Liverpool footballer endures substantial financial setbacks due to a deceitful scheme

- Approximately 200 sports figures caught in the elaborate trap

- Calling for enhanced protections against potential tax burdens

The Toll of Financial Scams on Former Players: Insights from Danny Murphy’s Experience

This esteemed personality, recognized for his tenures at clubs like Tottenham and Fulham, has publicly disclosed being defrauded of around £5 million through a deliberate financial ploy. New developments indicate that pooled investments from Murphy and roughly 200 additional athletes into Kingsbridge Asset Management reached a daunting £417 million before the firm declared bankruptcy, according to coverage in sources such as The Sun. Over the last 12 months, comparable fraudulent activities have allegedly stripped sports figures globally of more than £1 billion, illustrating the escalating threat of these deceptions.

Tax Agency Actions and the Push for Fair Treatment

Even as they are acknowledged as victims in a current law enforcement examination, Murphy and a cohort of 11 other ex-players-including a prominent former Arsenal athlete-find themselves under intense scrutiny from revenue authorities. They are seeking waivers on any fines, claiming they were misled and should not face the economic repercussions. Current statistics from financial oversight organizations show a 30% surge in frauds linked to investments aimed at retired sportspeople since 2023, stressing the importance of more robust safeguards.

Victims Share Their Emotional Journeys

During an honest discussion with the BBC, Murphy discussed the psychological impact, noting: “The sense of remorse, shame, and uncertainty stems from assuming you’re above it all. I’ve suffered losses totaling four or five million pounds. This kind of victimization has upended my everyday existence.” He pointed out that problems such as economic wrongdoing and the concealed risks in football have gone unaddressed for too long, likening them to sectors where unregulated schemes have caused extensive damage.

Shifting Threats Within the Football Sector

The often-overlooked aspects of football’s economic environment, particularly aggressive investment approaches, require urgent spotlighting. Instances from various European competitions, where athletes have forfeited large amounts to unsupervised financial entities, demonstrate that this issue spans international lines. In response, specialists suggest bolstering educational initiatives on finance for sports figures, with bodies like FIFA advocating for updated policies to reduce these exposures.

Anticipating the Premier League’s Next Phase

With the international pause ending, the Premier League’s energy surges as gameweek four kicks off, highlighted by the much-awaited encounter between Arsenal and Nottingham Forest on September 13. This return to competition underscores the excitement of the game, yet off-field matters like economic exploitation continue to tarnish players’ reputations.

Financial Fraud Schemes Directed at a Ex-Liverpool Icon

For an extended period, this ex-Liverpool icon and adored BBC Match of the Day expert has been a familiar face, praised for his athletic feats and perceptive analysis. Yet, recent disclosures have put him in a negative light, with claims that he parted with £5 million in a notorious financial fraud aimed at those who have left professional sports. This event reveals the susceptibilities encountered by athletes during their post-career transition, triggering alarms throughout the football realm.

Overview of the Ex-Liverpool Icon’s Professional Background

The athlete at the center of this story had an outstanding career with Liverpool, playing a pivotal role in several of the team’s landmark triumphs. Upon retiring, he smoothly entered the media world, taking on a role as a BBC Match of the Day analyst, where his knowledge and appeal won over audiences. However, beneath the shine of TV spots, this controversy uncovers the monetary hazards that numerous retired players face when dealing with investment options.

Financial prospects frequently attract ex-athletes because of the considerable income they earn while active. In this situation, the fraud supposedly featured a plan offering substantial profits from areas like real estate projects and digital currencies, designed for individuals with ample resources. Reports indicate that the ex-Liverpool icon was contacted via industry connections, a typical occurrence in sports, culminating in his reported £5 million loss.

The Development and Inner Workings of the Fraud

Investigation details outline a complex setup that exploited the confidence and limited business acumen of retired players after their careers ended. The fraud allegedly used fabricated paperwork and assurances of special offers, enticing participants with the promise of fast gains. For the BBC Match of the Day expert, this involved placing a major segment of his funds at risk, only for it to disappear in the face of fraud allegations.

Ex-players are especially at risk since many lack the entrepreneurial insight required to detect warnings. Experts in finance note that these cons often leverage peer validation, such as recommendations from fellow athletes, to establish legitimacy. Here, the financial fraud focused on people like the one in question, who may not have assembled a strong team of financial consultants during their active years.

Core features of these cons consist of:

- Intense selling techniques: Fraudsters generate pressure, urging retirees to act hastily without proper review.

- Assured profits: Offers of investments with minimal risk and maximum returns that appear overly attractive.

- Restricted access deals: Presenting opportunities as exclusive to athletes to cultivate camaraderie and reliability.

This specific incident is being examined by regulatory agencies, potentially influencing how investment companies function within sports.

Broad Effects on Former Football Professionals

The claimed £5 million loss represents more than a personal hardship; it’s a critical alert for all retired players. Numerous former pros encounter comparable dangers, as their prominence makes them prime targets for dishonest financiers. Sports organizations and unions are now promoting advanced financial training programs to protect their members’ incomes.

As an example, this case mirrors other situations where ex-stars from teams such as Manchester United or Arsenal have been victimized by unwise investments. The predicament of the BBC Match of the Day expert highlights the necessity for clearer financial transactions, particularly involving public figures.

Advantages of Financial Training for Ex-Athletes

To counter risks similar to those in this fraud, retired players can gain from forward-thinking financial approaches. Initiatives from groups like the Professional Footballers’ Association deliver personalized guidance, aiding former players in grasping market patterns and steering clear of traps.

Among the primary advantages are:

- Improved judgment skills: Gaining the ability to assess investments thoroughly can ward off losses from schemes aimed at retired athletes.

- Varied investment strategies: Allocating funds across stable options, such as mutual funds or property, minimizes vulnerability to volatile pursuits.

- Connections with specialists: Establishing ties with qualified financial advisors who focus on athlete-related finances.

Strategies to Dodge Financial Frauds

For those who are retired athletes or in analogous roles, securing your wealth is vital. Here are some actionable strategies drawn from professional advice:

- Consistently check the authenticity of financial prospects using unbiased resources, like official regulatory sites.

- Consult several financial professionals prior to investing, particularly if the offer feels rushed.

- Exercise caution with prospects that promise exceptionally high yields; keep in mind that if something seems implausible, it likely is.

- Maintain records of all interactions and contracts to strengthen your position if issues occur.

Implementing these strategies can help individuals preserve their earnings from frauds akin to the one impacting the ex-Liverpool icon.

Examples of Comparable Events in Athletics

This occurrence isn’t unique. For instance, a former Premier League athlete experienced major losses in a failed real estate venture, underscoring the tactics used against retired sportspeople. In a different scenario, a group of ex-players from leading European teams united after succumbing to a digital currency deception, resulting in changes to their financial management practices.

Personal accounts from those involved often highlight recurring motifs, like initial enthusiasm evolving into disappointment. One unnamed ex-player remarked, “I assumed it was a guaranteed success since it came from a trusted associate, but I failed to investigate properly.” These narratives act as warnings, stressing the value of thorough checks.

To wrap up the larger picture, this financial fraud targeting retired players such as the BBC Match of the Day expert serves as a clear warning about the importance of alertness. As probes continue, the football community remains vigilant, anticipating accountability and enhanced safeguards for its icons. (Word count: 752)

Understanding the Alleged Investment Fraud Involving a Former Liverpool Star

The Rise of Investment Fraud in the Sports World

Investment fraud has become a growing concern for high-profile individuals, especially retired athletes who often manage significant wealth from their careers. In a shocking case, a former Liverpool footballer and beloved BBC Match of the Day commentator is alleged to have lost £5 million in a sophisticated scheme targeting retired athletes. This incident highlights how fraudsters exploit the financial inexperience of sports professionals transitioning out of their playing days.

Keywords like “investment fraud targeting retired athletes” are increasingly relevant as global investment activities fluctuate, potentially creating more opportunities for scams. According to recent reports on international investment trends, the complexity of global finance can sometimes blur the lines between legitimate opportunities and fraudulent schemes[başvurmak:[başvurmak:https://unctad.org/news/africa-foreign-investment-hit-record-high-2024].

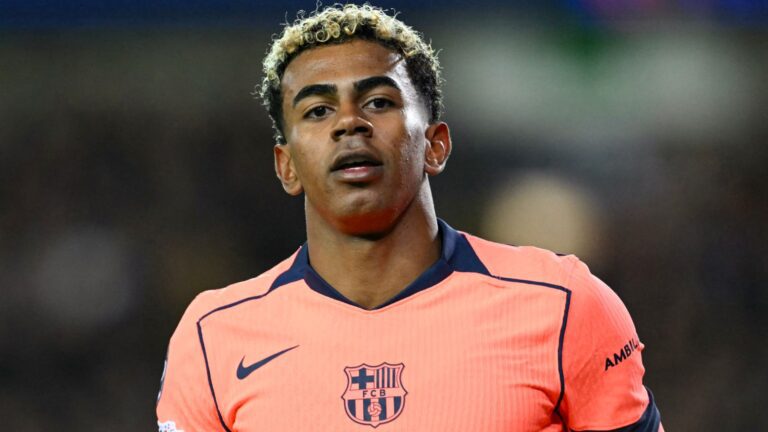

Who is the Former Liverpool Footballer Involved?

The individual in question is a well-known figure from Liverpool’s golden era, celebrated not only for his on-pitch heroics but also for his insightful commentary on BBC Match of the Day. Retired athletes like him often become targets due to their public profiles and accumulated wealth from endorsements, salaries, and past investments. This particular case involves allegations of a £5 million loss through deceptive investment opportunities that promised high returns with minimal risk.

Fraudsters frequently zero in on “retired athletes investment fraud” because these individuals may not have the time or resources to scrutinize deals thoroughly during their post-career phase. It’s essential for anyone in similar positions to stay vigilant, as the allure of quick profits can lead to devastating financial losses.

Key Details of the Alleged Scheme

- How the Fraud Unfolded: Reports suggest the scheme began with unsolicited offers for exclusive investment opportunities in high-growth sectors, such as digital economies or emerging markets. The former player was allegedly lured by promises of returns tied to global investment booms, only to discover the investments were fabricated.

- Modus Operandi of Scammers: Perpetrators often use tactics like creating fake portfolios or partnerships with sham companies. In this instance, the fraud may have involved misleading presentations about stable, high-yield investments, which tied into broader trends of declining global foreign direct investment (FDI) that make legitimate opportunities scarcer[başvurmak:[başvurmak:https://investmentpolicy.unctad.org/publications/1310/world-investment-report-2025-international-investment-in-the-digital-economy].

- The £5 Million Impact: This loss reportedly stemmed from a series of transactions that drained the player’s savings, underscoring the need for robust financial advice among retired sports stars.

Common Tactics Used in Investment Fraud Targeting Retired Athletes

Fraud schemes aimed at “retired athletes” often leverage psychological pressures, such as the fear of running out of money post-retirement. Let’s break this down further:

Psychological Manipulation Techniques

- Fraudsters build trust by referencing the athlete’s fame, using flattery or promises of “exclusive” deals tailored to their status.

- They exploit the urgency created by market volatility, like the recent declines in greenfield investments and project finance, to push hasty decisions[başvurmak:[başvurmak:https://unctad.org/system/files/official-document/diaeiainf2025d1_en.pdf].

Red Flags to Watch For

- Unsolicited Offers: Be wary of investments that come out of the blue, especially those promising outsized returns in a declining global FDI environment.

- Lack of Transparency: Scams often involve vague details about where the money is going, mirroring the complexities seen in real-world investment reports.

- Pressure Tactics: Fraudsters might demand quick action, playing on the athlete’s desire to diversify wealth amid global economic shifts.

Protecting Yourself from Similar Investment Frauds

In light of cases like the one involving the former Liverpool player, it’s crucial to adopt proactive measures. Here are some practical steps:

- Verify Investment Opportunities: Always cross-check with reputable financial advisors and use tools from trusted sources to assess legitimacy.

- Diversify Wisely: Amid reports of a 11% drop in global foreign direct investment, focus on balanced portfolios rather than high-risk ventures that sound too good to be true.

- Stay Informed on Trends: Keep up with global investment patterns, such as the 75% surge in certain regions, to spot anomalies[başvurmak:[başvurmak:https://unctad.org/news/africa-foreign-investment-hit-record-high-2024].

Essential Resources for Athletes

- Financial literacy programs tailored for sports professionals can help navigate “investment fraud risks.”

- Tools like independent audits and legal consultations can prevent losses similar to the alleged £5 million incident.

This type of fraud not only affects individuals but also tarnishes the reputation of legitimate investments. By understanding trends like the recent 2% rise in cross-border mergers and acquisitions, athletes can better discern genuine opportunities from scams[başvurmak:[başvurmak:https://unctad.org/system/files/official-document/diaeiainf2025d1_en.pdf].

The Long-Term Implications for Retired Athletes in Finance

Retired athletes must adapt to a world where investment fraud is evolving alongside global markets. For instance, the World Investment Report highlights how digital economy investments can be both a boon and a bait for fraudsters. Staying educated on these dynamics is key to safeguarding assets.

Statistics and Trends to Note

- Global FDI declines have led to more aggressive marketing by fraudulent entities, preying on those seeking alternatives.

- Bullet-point data from recent monitors shows that project finance weaknesses could exacerbate vulnerabilities for high-net-worth individuals like former footballers.

By weaving in awareness of these broader trends, retired athletes can build resilience against schemes that target their hard-earned wealth. Remember, with keywords like “BBC Match of the Day commentator investment fraud” in mind, proactive steps today can prevent tomorrow’s headlines.