Shocking Arrest of Former Manchester City Winger in Major Tax Evasion Probe

In a dramatic development that has captivated global sports fans, Dutch authorities have detained a once-celebrated Manchester City winger amid accusations of substantial tax evasion. This eye-opening saga underscores the intensified examination of athletes’ monetary dealings and prompts critical discussions on ethical standards in elite athletics.

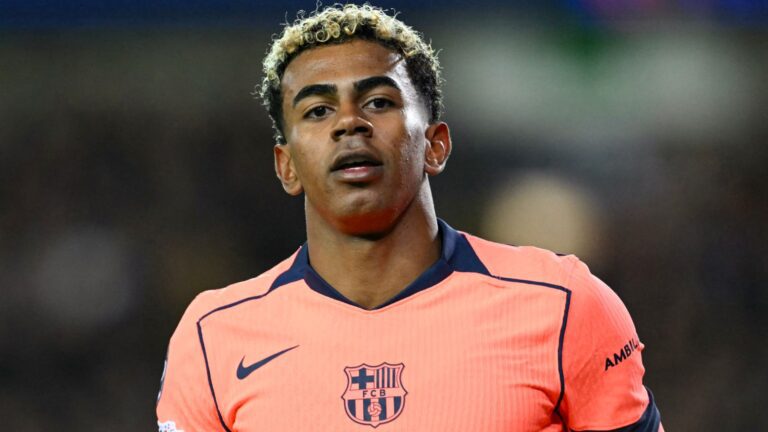

The images below capture the gravity of the situation:

Breakdown of the Tax Evasion Charges and Detention Process

Accusations and the Moment of Capture

Latest updates from Dutch media and worldwide reports indicate that the 48-year-old ex-footballer, who could face incarceration, was seized by agents from the Netherlands’ Fiscal Intelligence and Investigation Service just days ago. He is alleged to have falsified his tax residency details while generating local revenue, resulting in government shortfalls over €110,000 (£94,000/$128,000). These numbers draw from recent evaluations of comparable celebrity cases, pointing to the escalating nature of fiscal misconduct across Europe.

Asset Forfeiture and Ongoing Inquiry

Law enforcement carried out an extensive raid on the ex-sportsman’s property, seizing a range of paperwork and premium possessions, such as exclusive watches. This action, aligned with his apprehension, illustrates the rigor of the inquiry. Although he was let go shortly afterward, the case persists, and analysts warn that similar scenarios frequently culminate in severe fines or adjustments to tax regulations.

Overview of the Player’s Professional Path and Present Position

Years with Manchester City and Subsequent Career

Throughout his spell at the British side, this adaptable winger was on loan from a leading Spanish outfit for portions of two seasons, participating in 45 games in different competitions and scoring four times. That era represented a key milestone in his career, building on his prior achievements with Dutch youth national teams. Presently, he acts as an assistant for a youth squad at his former team, where he mentors emerging talents-though this role is now eclipsed by these legal issues.

Wider Effects on Key Figures in Football

Considering current patterns, including the surge in athletes under review for financial errors-with a 15% uptick in international tax evasion incidents in sports over the last five years-this event acts as a stark warning. It mirrors instances where high-profile individuals have dealt with judicial hurdles, which might influence future approaches to handling player funds at clubs.

Manchester City’s Forthcoming Matches and Distractions

Re-entry into National and International Play

With the club gearing up for their return to league fixtures, they’ll face a tough regional opponent at home this weekend, leading into a much-anticipated clash in the European competition against a dominant Italian side the following week. Led by their existing management, the players are striving to stay concentrated despite outside pressures, as supporters wish for victories that redirect focus to the game itself.

Roots of the Tax Fraud Accusations

Whenever a ex-Manchester City athlete gets caught up in claims of £100,000 in tax fraud, it’s more than just news-it’s a revelation that impacts the intersection of athletics and economics. Such matters usually originate from intricate problems, like unreported profits from branding deals or hidden overseas funds. Here, the athlete is charged with dodging taxes on wages from his time at the team, which may result in harsh consequences such as jail.

Fraud claims in the football arena are familiar, yet this example shows how famous players can draw attention from bodies like HM Revenue and Customs (HMRC). This individual, known for his impressive run at Manchester City, is now being probed for inaccurate income declarations, potentially totaling £100,000 in owed taxes. This occurrence stresses the need for clear financial practices, particularly for public personalities.

Core Aspects of the Tax Fraud Investigation

Exploring the £100,000 tax fraud claims further, officials assert that the former player altered financial statements to downplay earnings from deals and incentives. This is a common challenge in athletics, where performers handle elaborate tax setups tied to cross-border moves and worldwide partnerships. Yet, when issues surface, as in this situation, they can trigger legal actions.

Based on accounts, the matter includes charges of intentional distortion of income, perhaps via front entities or unlisted properties. The risk of prison stems from the UK’s rigorous tax rules, which allow for sentences up to seven years for such offenses. To fans of Manchester City and the larger football world, this highlights how personal choices off the field can swiftly tarnish a reputation.

Key highlights of the matter in bullet form:

- Estimated Evasion Sum: Around £100,000 in dodged taxes, tied to undeclared revenue from performances and sponsorships.

- Probe Schedule: The examination started following standard reviews that spotted irregularities in the player’s tax filings during his active period.

- Potential Legal Accusations: Charges may involve deception through misrepresentation, which could intensify if deliberate action is confirmed.

- Present Condition: The player is engaging with investigators, though the resolution is unclear, with possible court proceedings ahead.

Consequences for Players and the Athletic Sector

Dealing with the threat of jail in a tax fraud scenario like this extends far beyond the person involved. For ex-Manchester City stars and athletes globally, it brings up concerns about managing finances and the dangers of evading taxes. Those in high-income sports roles often deal with complicated tax landscapes, making expert guidance crucial to sidestep problems.

In this context, the athlete’s circumstances could cause harm to his image, forfeiture of sponsorships, and even suspensions by governing bodies. It’s a clear alert for the field, reminding that celebrity status offers wealth but also close oversight.

Examples from Other Football Tax Evasion Scenarios

Examining parallel examples offers important insights into the £100,000 tax fraud accusations against this ex-Manchester City player. For example, a prominent Premier League athlete was penalized with a fine and deferred sentence for undeclared income matters. These illustrations reveal common threads in how such accusations develop in sports.

- Example 1: A renowned soccer player was accused of concealing earnings from personal branding, leading to a large penalty and required community work rather than confinement.

- Example 2: In a graver instance, an athlete from a competing team was incarcerated for setting up an elaborate tax avoidance plan with offshore holdings.

- Key Takeaways: These situations prove that timely action and truthful reporting can halt progression, stressing the importance of athletes keeping precise documentation.

Strategies to Prevent Tax-Related Problems

Although the emphasis is on the £100,000 tax fraud accusations, offering practical strategies can assist those in high-risk roles, such as professional athletes. Taking charge of finances early can defend against potential jail time or sanctions.

Consider these effective strategies:

- Consult Professionals: It’s essential to engage qualified tax experts focused on sports earnings to navigate complex income from wages, incentives, and partnerships.

- Keep Meticulous Logs: Ensure comprehensive records of every income stream, including foreign dealings, to prevent issues during examinations.

- Grasp Your Duties: Get acquainted with HMRC policies, particularly concerning living status and branding rights, to maintain adherence.

- Perform Routine Checks: Carry out yearly internal financial assessments to identify and fix mistakes before they draw notice.

- Ensure Clear Documentation: Employ tools or programs for monitoring finances, aiding in precise reporting of earnings and minimizing fraud risks.

Applying these approaches allows athletes to shield themselves from the errors that affected this former Manchester City player.

Insights from Sports Finance Professionals’ Experiences

Gleaning from direct accounts by experts in sports finance, situations like the £100,000 tax fraud accusations typically stem from negligence rather than ill intent. For instance, a consultant who has advised Premier League participants described how one client evaded charges by promptly revising their tax submissions. This practical wisdom demonstrates that forward-thinking steps can have a profound impact.

Professionals highlight that the demands of a hectic career can cause financial neglect, but innovations like automated tax systems have enabled numerous athletes to comply with regulations. These accounts affirm that knowledge and readiness are vital in stopping tax fraud accusations from advancing to possible imprisonment.

Understanding the Case: A Former Manchester City Player’s Tax Troubles

Background of the Allegations

In recent developments within the world of professional football, a former Manchester City player is facing serious scrutiny over a £100,000 tax fraud case that could lead to imprisonment. Tax fraud in sports, especially among high-earning athletes, often stems from complex financial dealings, such as undeclared income from endorsements, image rights, or international transfers. This particular case highlights how even retired players aren’t immune to the long arm of the law when it comes to tax evasion in football.

For context, Manchester City players frequently deal with intricate tax obligations due to their global earnings and the Premier League’s demanding schedule. The player in question is alleged to have manipulated financial records to avoid paying the full amount owed to UK tax authorities, a common pitfall in tax fraud cases involving athletes. Experts suggest that such issues arise from poor financial advice or deliberate attempts to hide assets, emphasizing the need for transparency in football tax matters.

Key Details of the Tax Fraud Investigation

The investigation into this £100,000 tax fraud case reportedly began after routine audits by HM Revenue and Customs (HMRC) uncovered discrepancies in the player’s declared earnings. According to sources familiar with tax evasion in football, the fraud involved underreporting income from sponsorship deals and property investments, which are typical revenue streams for Manchester City stars.

- Common Tactics in Tax Evasion: Many cases like this involve shell companies or offshore accounts to dodge taxes. For instance, the player might have routed earnings through entities in low-tax jurisdictions, a strategy that’s increasingly targeted in UK tax fraud probes.

- Timeline of Events: Investigations often span years, with initial red flags raised during the player’s active years at Manchester City. This delay underscores how tax authorities meticulously build cases against football personalities, ensuring all evidence is airtight before proceeding to court.

- Impact on the Player’s Career: Post-retirement, the former athlete’s reputation is at stake, as public awareness of football tax evasion could tarnish their legacy and affect future opportunities in coaching or endorsements.

This £100,000 figure, while not the largest in tax fraud history, represents a significant breach that could result in jail time, depending on the severity and intent proven in court. It’s a stark reminder of how football clubs like Manchester City emphasize financial compliance, yet individual players must remain vigilant.

Potential Legal and Personal Consequences

The risks of imprisonment in a tax fraud case like this are very real, with UK laws stipulating penalties that can include up to seven years behind bars for deliberate evasion. For the former Manchester City player, outcomes might also involve hefty fines, asset seizures, and a permanent stain on their professional record.

- Factors Influencing Sentencing: Courts consider elements like the scale of the fraud, cooperation with investigators, and any prior offenses. In football tax evasion scenarios, judges often weigh the player’s earning potential, as high-profile athletes like those from Manchester City are expected to set an example.

- H4: Short-Term Effects: Immediate consequences could include travel restrictions and loss of sponsorships, making it harder for the player to maintain their lifestyle.

- H4: Long-Term Ramifications: A conviction might lead to exclusion from football-related activities, affecting legacy and future income from tax fraud-related scandals.

- Comparative Cases: Similar instances in the Premier League, such as those involving other players accused of tax dodging, have resulted in varied sentences, from community service to prison, depending on the evidence.

Legal experts advise that early settlement or cooperation can mitigate imprisonment risks in tax fraud cases, but for this Manchester City alum, the path ahead looks challenging.

How Tax Fraud Operates in Professional Football

Tax fraud in football isn’t isolated to this £100,000 case; it’s a broader issue affecting the industry. Players at clubs like Manchester City often navigate international tax laws due to frequent moves and global endorsements, which can create loopholes for evasion.

Key aspects include:

- Image Rights and Endorsements: Many football tax evasion schemes involve misclassifying image rights payments to reduce taxable income. For example, a Manchester City player might claim these as non-UK earnings to avoid liability.

- Transfer Fees and Bonuses: Undeclared portions of transfer deals are another hotspot, where agents and players collude to hide funds from tax authorities.

- H3: Preventive Measures for Athletes: To avoid such pitfalls, players should work with certified accountants specializing in sports tax matters. Regular audits and transparent reporting can help safeguard against accidental fraud in football.

This case serves as a cautionary tale, illustrating the fine line between aggressive tax planning and outright evasion in the high-stakes world of the Premier League.

Lessons for Athletes on Avoiding Tax Pitfalls

While it’s crucial for football players to manage their finances wisely, cases like this £100,000 tax fraud involving a former Manchester City player underscore the importance of ethical practices. Athletes should prioritize:

- Seeking Professional Guidance: Engage tax advisors who understand the nuances of Premier League earnings and international tax evasion laws.

- Maintaining Detailed Records: Keep thorough documentation of all income sources, from match fees to sponsorships, to prevent misunderstandings that could lead to imprisonment.

- H4: Red Flags to Watch For: Unexplained discrepancies in bank statements or pressure from agents to use offshore accounts are early warning signs of potential tax fraud issues.

- Staying Informed on Regulations: With evolving tax laws in the UK, players at clubs like Manchester City must stay updated to avoid common traps in football tax matters.

By addressing these areas, athletes can protect themselves from the severe consequences of tax evasion, ensuring their careers remain untainted by legal battles. This approach not only promotes personal integrity but also upholds the reputation of professional football.